Win Big from the Crypto Crash with 3 ASX Stocks to Buy Now

By Fil Tortevski and Pedro Banales

When Bitcoin crashes, most traders panic. But at Wealth Within, we see opportunity, because history shows that downturns in unregulated markets like crypto often lead to powerful gains in more stable, well-governed markets such as the ASX.

In this post, we’ll break down the latest Bitcoin outlook, explore why the crypto market is falling, and reveal three Australian stocks poised to benefit from the current shift in investor sentiment.

Bitcoin’s New Reality: What the Charts Are Showing

Bitcoin has a history of spectacular rises and equally dramatic crashes. Since its inception, every major rally has been followed by a correction of 75–90%. True to form, after reaching new highs earlier this year, Bitcoin has fallen sharply again, with analysts predicting potential lows near $25,000 in the coming cycle.

At Wealth Within, our analysts have studied these long-term trends and found that Bitcoin typically peaks every four years before a major correction. For investors, this presents both a warning and an opportunity: while the crypto space becomes volatile, other asset classes, particularly regulated markets like the ASX, often attract renewed interest and capital flows.

Why the ASX Offers Safer, Stronger Opportunities

As traders abandon risky crypto assets, the Australian Stock Exchange emerges as a haven for disciplined investors. Where crypto offers chaos, the ASX offers structure, governance, and transparency, qualities that allow you to trade with consistency, not gambling instincts.

For investors ready to pivot from speculation to strategy, our trading courses show you how to analyse, plan, and manage risk effectively. From technical analysis to money management, you’ll learn the practical steps professional traders take to protect and grow their capital.

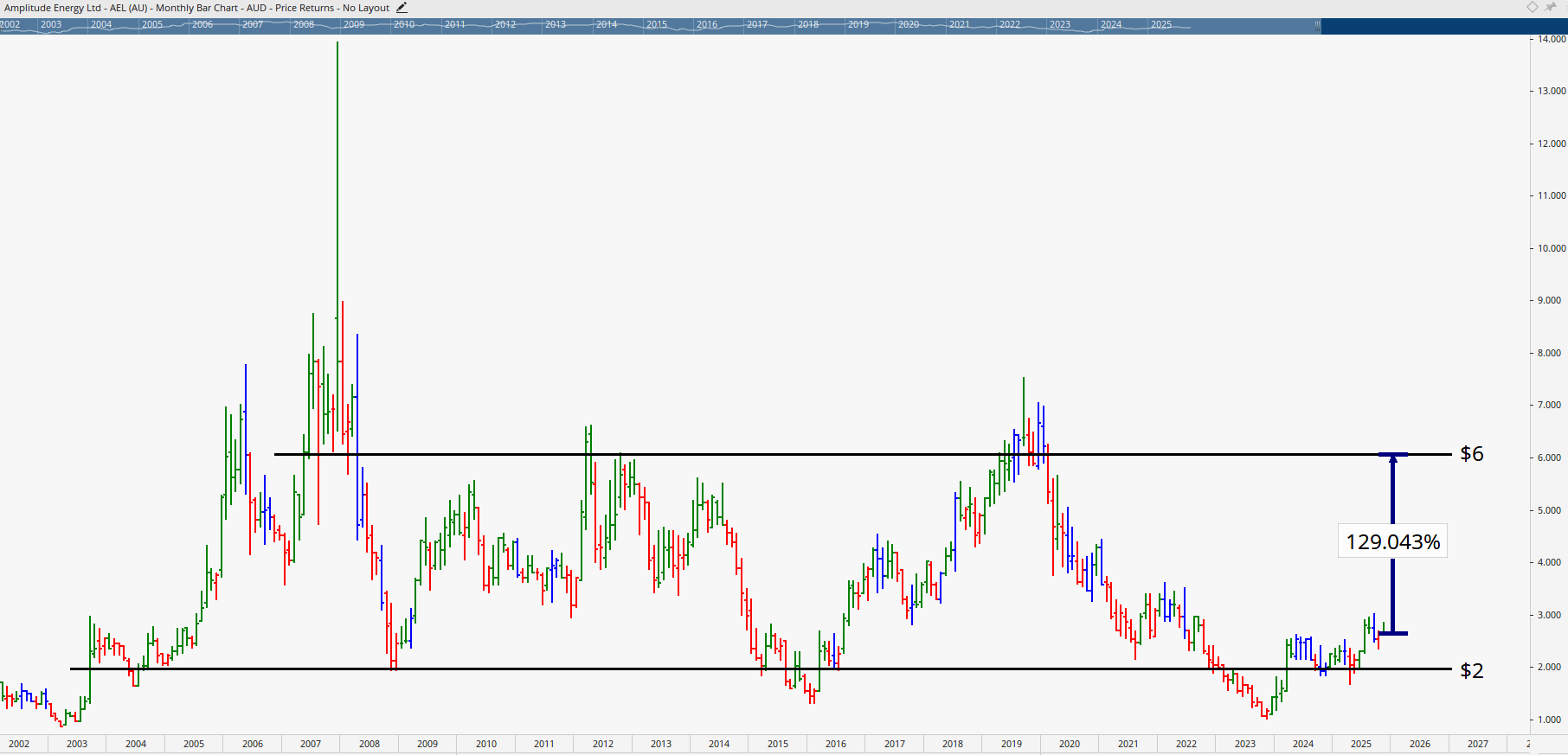

1. Amplitude Energy (AEL): Powering Up from the Bottom

Energy stocks are proving resilient as global demand stabilises. Amplitude Energy (formerly Cooper Energy) has formed a powerful base around the $2 level and is showing technical signs of a breakout.

With potential upside targets around $6, the stock represents a 130% growth opportunity, offering a more stable alternative to crypto’s volatility. Its price structure and momentum make it ideal for traders who prefer steady gains over sudden crashes.

For those looking to deepen their understanding of trading setups like this, our Short Course in Share Trading can help build your technical foundation quickly and effectively.

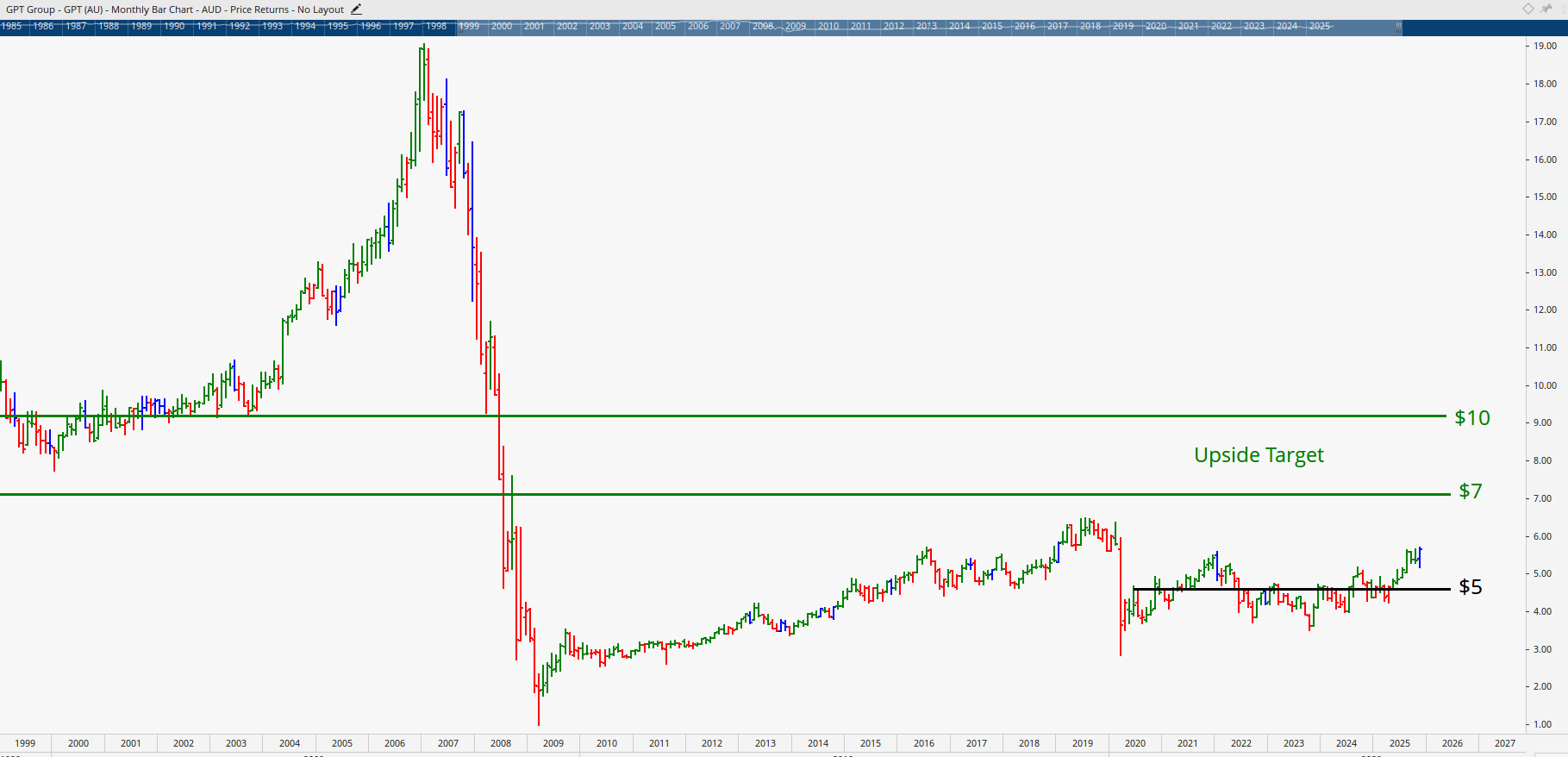

2. GPT Group (GPT): Property Strength Through Market Turbulence

While tech and crypto markets falter, property remains a reliable performer. GPT Group, a prominent property REIT, has shown solid consolidation around $5.00, with strong potential to rally toward $7 or even $10, which is an 85% possible upside.

REITs are often less correlated with tech or digital assets, giving investors valuable diversification. This stability makes them an ideal choice for those learning to trade in different sectors for balance and risk control.

For a comprehensive pathway to professional-level mastery, the Diploma of Share Trading and Investment offers in-depth training on reading price trends, identifying entry points, and managing trades across multiple markets.

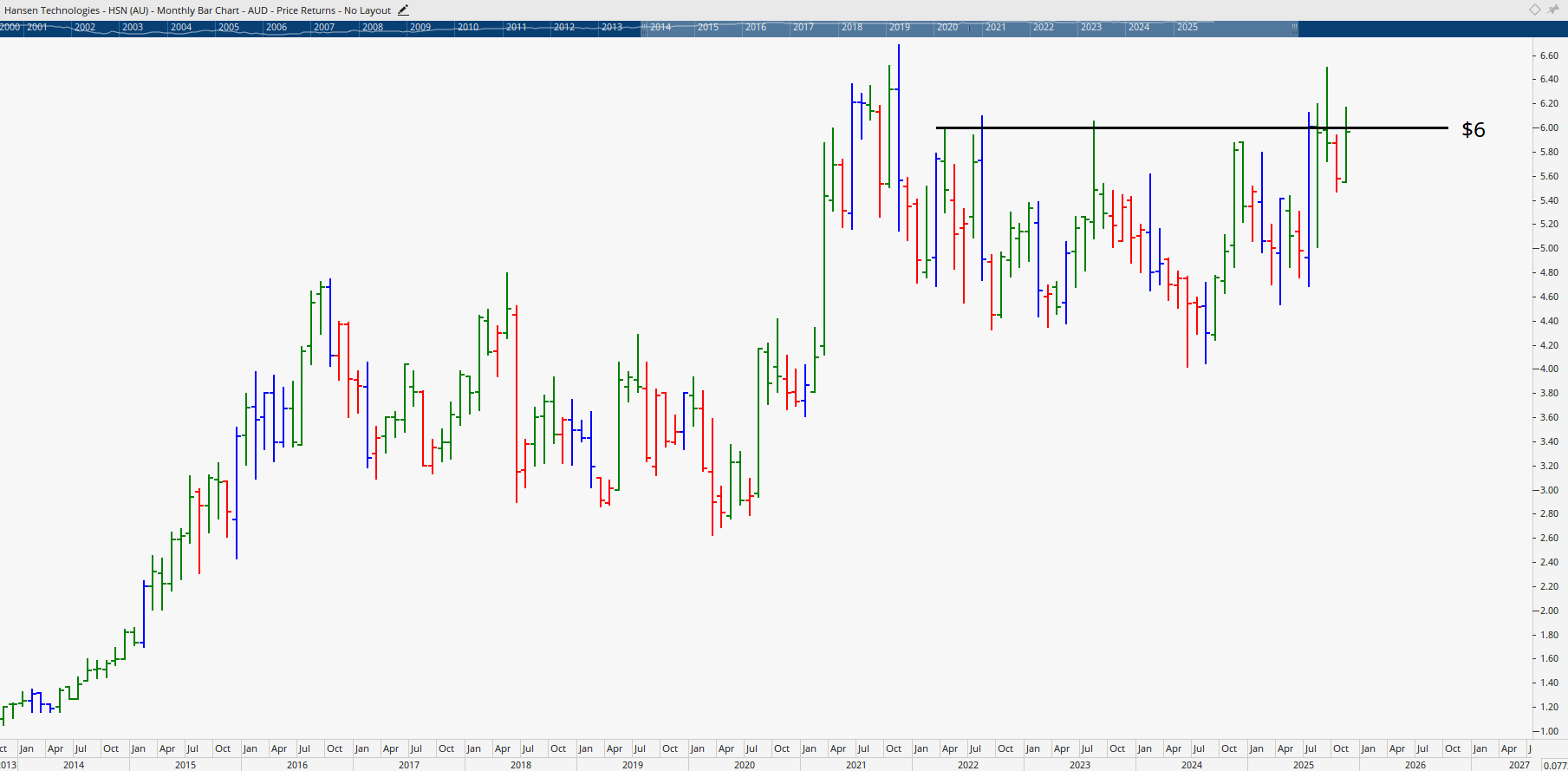

3. Hansen Technologies (HSN): A Quiet Performer in Tech

In a sector shaken by volatility, Hansen Technologies remains a standout. The stock has trended sideways but is now forming a bullish setup that could mark the beginning of a strong upward leg.

Unlike speculative tech plays, Hansen provides essential technology services, giving it a defensive edge with strong upside potential. A strong break above $6 could see long-term growth as the stock benefits from rising demand in digital infrastructure.

Investors looking to refine their strategies for identifying strong, resilient stocks should consider our Advanced stock trading course, designed to help traders move beyond fundamentals and master timing, Elliott Wave analysis, and portfolio construction.

Avoid Crypto Mistakes and Trade Like a Pro

The crypto crash has highlighted a painful truth: emotion-driven investing leads to losses. Smart traders follow rules, not hype. They understand risk, apply structure, and trade only when probabilities are in their favour.

If you’ve felt the sting of crypto losses, now is the time to pivot toward strategy, discipline, and education. At Wealth Within, we pride ourselves on providing real-world share trading education that turns confusion into competency.

You can also access regular Hot Stock Tips videos in our ASX video library for expert insights into emerging market opportunities.

Take Control of Your Financial Future

Every market shift creates winners and losers, the difference lies in preparation. The ASX is full of stocks quietly building the next bull run, and those who act now position themselves to benefit.

The Bitcoin crash is not the end, it’s a new opening.

By focusing on growth-backed, income-generating ASX stocks like Amplitude Energy, GPT Group, and Hansen Technologies, you can trade with greater confidence and control.

It’s time to stop hoping and start learning how to win smarter. If you’re ready to trade with skill, not guesswork, learn from Australia’s most trusted educators.

Visit About Wealth Within to understand how we’ve spent over two decades helping Australians achieve financial freedom through professional training.